- Accueil

- Qui nous sommes

- Nos projets

- Investisseurs

- Aperçu

- Informations sur les actions

- Présentations

- Événements et webdiffusions

- Rapports et états financiers

- Couverture des analystes

- Assemblée des actionnaires

- Assemblée extraordinaire des actionnaires en vue d’approuver le remboursement de capital provenant de l’opération de scission avec Archer Exploration Corp.

- Médias et articles

- Dépôts SEDAR+

- Investisseurs américains - PFIC

- Communiqués

- Développement durable

- Nous joindre

- EN

Wallbridge Intersects 9.06 g/t Gold Over 40.05 Metres, including 16.33 g/t Gold Over 19.85 Metres in High-Grade Core of Lower Tabasco Zone

Wallbridge Intersects 9.06 g/t Gold Over 40.05 Metres, including 16.33 g/t Gold Over 19.85 Metres in High-Grade Core of Lower Tabasco Zone

Toronto, Ontario – October 19, 2020 – Wallbridge Mining Company Limited (TSX:WM) (“Wallbridge” or the “Company”) is pleased to report the first assay results from the ongoing 15-40 metre spaced infill drilling program to better define the high-grade core of the Lower Tabasco zone on its 100%-owned Fenelon Gold Property (“Fenelon” or the “Property”). Results of FA-19-086-W1, the first of five wedge cuts correlate well with the results of FA-19-086.

| FA-19-086-W1 | 9.06 g/t Au (8.82 g/t Au Cut) over 40.05 metres, including |

Note: Further assay results are pending from this drill hole. Drill hole composites reported as "cut" contain higher grade samples that have been cut to 140 g/t Au. | |

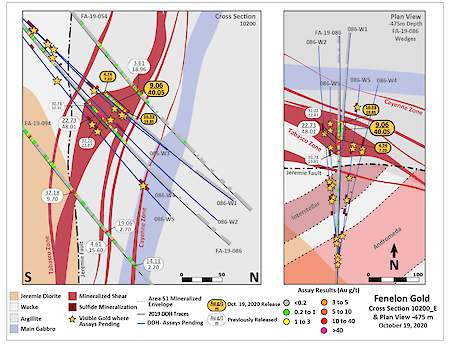

These results confirm the presence of high-grade mineralization 25 metres above the original FA-19-086 intersection of 22.73 g/t Au over 48.01 metres including 32.22 g/t Au over 22.87 metres (see Wallbridge Press Release dated December 3rd, 2019) and mirror the grade distribution in FA-19-086 (see Figs. 1 and 2).

A comparison of the two intersections is shown in Table 1 below.

| Table 1. Comparison of Tabasco zone intersections in hole FA-19-086 and wedge cut FA-086-W1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| FA-19-086 Original Hole | FA-19-086-W1, Wedge Cut 25 metres above | ||||||||

| From (m) | To (m) | Length (m) | Au (g/t) | Au Cut (g/t) | From (m) | To (m) | Length (m) | Au (g/t) | Au Cut (g/t) |

Total Intersection | 595.67 | 643.68 | 48.01 | 22.73 | 18.87 | 603.50 | 643.55 | 40.05 | 9.06 | 8.82 |

Including… | 595.67 | 606.58 | 10.91 | 30.78 | 30.32 | 603.50 | 610.70 | 7.20 | 4.74 | 4.74 |

And... | 606.58 | 616.37 | 9.79 | 0.81 | 0.81 | 610.70 | 623.70 | 13.00 | 0.34 | 0.34 |

And... | 616.37 | 639.24 | 22.87 | 32.22 | 24.33 | 623.70 | 643.55 | 19.85 | 16.33 | 15.84 |

Which includes… | 616.37 | 625.50 | 9.13 | 68.81 | 49.06 | 635.65 | 643.55 | 7.90 | 38.67 | 37.45 |

“Given the expected variability of this style of high-grade gold mineralization, the degree of consistency in terms of style of mineralization and grade distribution shown by these two intersections 25 metres apart could hardly be better,” stated Attila Péntek, Vice President Exploration of Wallbridge.

“Our aggressive, 50 to 100-metre spaced step-out drilling has been successful in expanding the footprint and size potential of the Fenelon Gold System. In order to deliver a robust maiden resource estimate, we are now increasingly doing more in-fill drilling at much tighter, 15 to 40-metre drill spacing to confirm continuity and grade. The visual results of the five wedge cuts completed around hole FA-19-086, and today’s assays from the first wedge cut have demonstrated excellent continuity in Tabasco’s high-grade domain and we are now continuing in-fill drilling in other parts of the Tabasco and Cayenne zones. This tighter spaced drilling has also led to the initial modelling of the Jeremie Fault which is now recognized as an important structural control for gold deposition in the Fenelon Gold System.”

Additional in-fill and step-out results on from the Tabasco and Cayenne zones are as follows:

| FA-20-159-W1 | 2.77 g/t Au over 36.00 metres in the Tabasco Zone, including |

| FA-20-155 | 1.78 g/t Au over 49.50 metres, including |

| FA-20-153 | 3.11 g/t Au over 15.70 metres, including |

| FA-20-161 | 1.01 g/t Au over 42.00 metres, including |

2020 Drilling Program Update

To September 30, 2020, approximately 75,000 metres of the planned fully-funded 100,000-metre 2020 drilling program have been completed. Currently, five of six drill rigs are focusing on expanding the Tabasco-Cayenne-Area 51 mineralization on the original Fenelon Gold Property, carrying out a combination of 50-100-metre step-outs and tighter-spaced in-fill drilling. The sixth drill rig is actively exploring the connection of the Tabasco-Cayenne-Area 51 gold system to the Ripley-Reaper area and the Sunday Lake Deformation Zone. Consideration has been given to increasing the scope and size of the planned 2020 and 2021 drilling programs to be able to fully assess the ultimate size potential of this rapidly growing gold system (see Wallbridge Press Release dated Oct 13, 2020).

Final assay results of eight (FA-20-144, -146, -154, -155, -159-W1, -161, -167, and -171) and partial assay results of four (FA-19-086-W1, FA-20-140, -153, and -176) surface drill holes of the 2020 exploration drill program are reported in the Table and Figures below. All figures and a table with drill hole information of recently completed holes are posted on the Company’s website under “Current Program” at https://www.wallbridgemining.com/s/fenelon.asp.

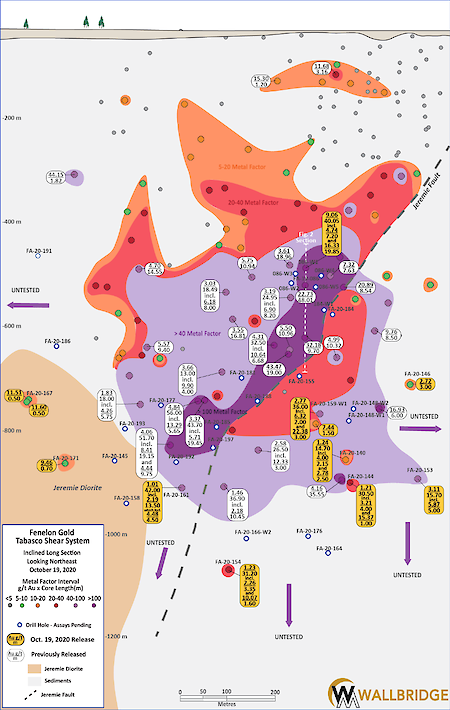

Figure 1. Fenelon Gold, Tabasco Long Section

Figure 2. Fenelon Gold, FA-19-086 Wedges, Plan View and Cross Section

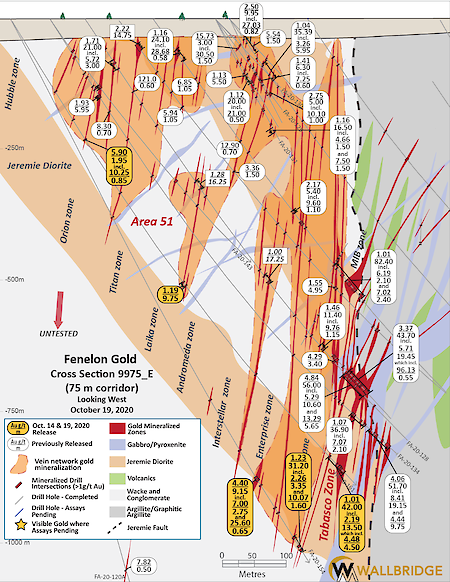

Figure 3. Fenelon Gold, Cross Section 9975

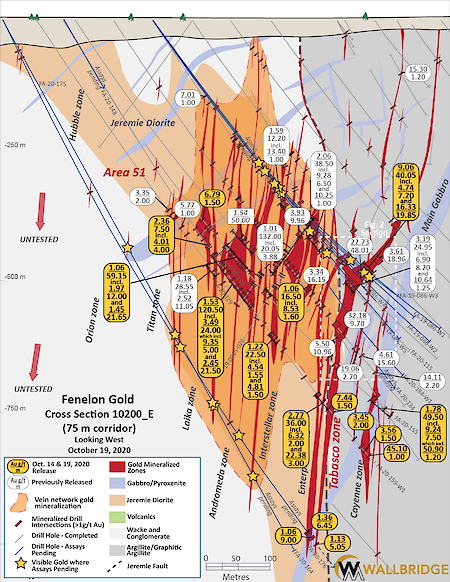

Figure 4. Fenelon Gold, Cross Section 10200

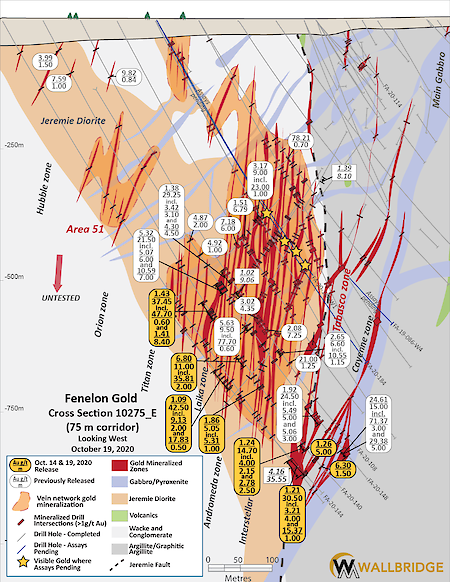

Figure 5. Fenelon Gold, Cross Section 10275

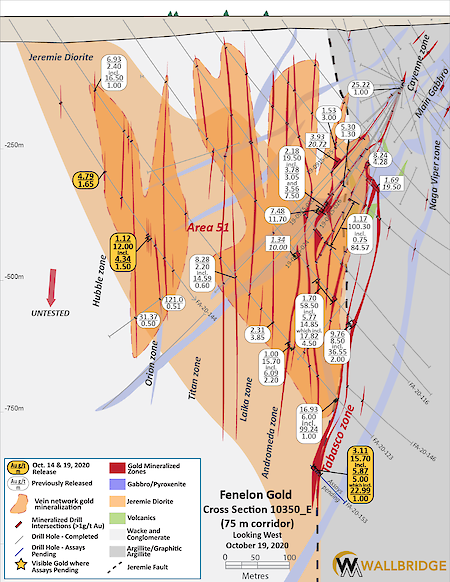

Figure 6. Fenelon Gold, Cross Section 10350

| Table 2. Wallbridge Fenelon Gold Property 2020 Drill Assay Highlights (1) | ||||||||

|---|---|---|---|---|---|---|---|---|

Drill Hole | From (m) | To (m) | Length (m) | Au (g/t) | Au Cut(2) (g/t) | VG(3) | Zone/Corridor | Section |

FA-19-086-W1 | 603.50 | 643.55 | 40.05 | 9.06 | 8.82 | VG | Tabasco | 10200E |

Including… | 603.50 | 610.70 | 7.20 | 4.74 | 4.74 | VG | Tabasco | 10200E |

And… | 623.70 | 643.55 | 19.85 | 16.33 | 15.84 | VG | Tabasco | 10200E |

Which includes… | 635.65 | 643.55 | 7.90 | 38.67 | 37.45 | VG | Tabasco | 10200E |

FA-20-140 | 953.80 | 968.50 | 14.70 | 1.24 | 1.24 |

| Tabasco | 10275E |

Including… | 953.80 | 955.95 | 2.15 | 4.00 | 4.00 |

| Tabasco | 10275E |

And… | 966.00 | 968.50 | 2.50 | 2.78 | 2.78 |

| Tabasco | 10275E |

FA-20-140 | 991.00 | 996.00 | 5.00 | 1.26 | 1.26 |

| Tabasco | 10275E |

FA-20-140 | 1010.50 | 1012.00 | 1.50 | 6.30 | 6.30 |

| Tabasco | 10275E |

FA-20-144 | 1055.50 | 1086.00 | 30.50 | 1.21 | 1.21 | VG | Tabasco | 10275E |

Including… | 1057.00 | 1061.00 | 4.00 | 3.21 | 3.21 |

| Tabasco | 10275E |

And… | 1077.00 | 1078.00 | 1.00 | 15.37 | 15.37 | VG | Tabasco | 10275E |

FA-20-146 | 915.00 | 918.00 | 3.00 | 2.72 | 2.72 |

| Tabasco | 10425E |

FA-20-153 | 1030.30 | 1046.00 | 15.70 | 3.11 | 3.11 |

| Tabasco | 10350E |

Including… | 1041.00 | 1046.00 | 5.00 | 5.87 | 5.87 |

| Tabasco | 10350E |

Which includes… | 1041.00 | 1042.00 | 1.00 | 22.99 | 22.99 |

| Tabasco | 10350E |

FA-20-154 | 1133.30 | 1164.50 | 31.20 | 1.23 | 1.23 | VG | Tabasco | 9975E |

Including… | 1133.30 | 1136.65 | 3.35 | 2.26 | 2.26 |

| Tabasco | 9975E |

And… | 1162.05 | 1163.65 | 1.60 | 10.07 | 10.07 | VG | Tabasco | 9975E |

FA-20-155 | 943.00 | 992.50 | 49.50 | 1.78 | 1.78 | VG | Tabasco | 10200E |

Including… | 943.00 | 950.50 | 7.50 | 9.24 | 9.24 | VG | Tabasco | 10200E |

Which includes… | 946.00 | 947.20 | 1.20 | 50.90 | 50.90 | VG | Cayenne | 10200E |

And… | 991.00 | 992.50 | 1.50 | 7.28 | 7.28 |

| Cayenne | 10200E |

FA-20-159-W1 | 868.00 | 904.00 | 36.00 | 2.77 | 2.77 | VG | Tabasco | 10200E |

Including… | 873.00 | 875.00 | 2.00 | 6.32 | 6.32 |

| Tabasco | 10200E |

And… | 886.00 | 889.00 | 3.00 | 22.38 | 22.38 | VG | Tabasco | 10200E |

FA-20-159-W1 | 916.00 | 917.50 | 1.50 | 7.44 | 7.44 |

| Tabasco | 10200E |

FA-20-159-W1 | 980.00 | 982.00 | 2.00 | 3.45 | 3.45 |

| Cayenne | 10200E |

FA-20-159-W1 | 1010.50 | 1012.00 | 1.50 | 3.56 | 3.56 |

| Cayenne | 10200E |

FA-20-159-W1 | 1023.00 | 1024.00 | 1.00 | 45.10 | 45.10 |

| Cayenne | 10200E |

FA-20-161 | 1041.00 | 1083.00 | 42.00 | 1.01 | 1.01 | VG | Tabasco | 9975E |

Including… | 1060.50 | 1074.00 | 13.50 | 2.19 | 2.19 | VG | Tabasco | 9975E |

Which includes… | 1069.50 | 1074.00 | 4.50 | 4.48 | 4.48 | VG | Tabasco | 9975E |

FA-20-167 | 997.70 | 998.20 | 0.50 | 11.51 | 11.51 | VG | Cayenne | 9750E |

FA-20-167 | 1006.50 | 1007.00 | 0.50 | 11.60 | 11.60 | VG | Cayenne | 9750E |

FA-20-171 | 1028.30 | 1029.00 | 0.70 | 9.46 | 9.46 |

| Tabasco | 9750E |

FA-20-176 | 1144.00 | 1150.45 | 6.45 | 1.36 | 1.36 | VG | Tabasco | 10200E |

FA-20-176 | 1159.00 | 1168.00 | 9.00 | 1.06 | 1.06 |

| Tabasco | 10200E |

FA-20-176 | 1171.50 | 1176.55 | 5.05 | 1.13 | 1.13 |

| Tabasco | 10200E |

(1) Table includes only assay results received since the latest press release on Tabasco-Cayenne results dated August 11, 2020. | ||||||||

(2) Higher grade assays have been cut to 140 g/t Au. | ||||||||

(3) Intervals containing visible gold ("VG"). | ||||||||

Note: True widths are estimated to be 50-80% of the reported core length intervals.

Assay QA/QC and Qualified Persons

Drill core samples from the ongoing drill program at Fenelon are cut and bagged either on site or by contractors and transported to either SGS Canada Inc. or ALS Canada Ltd. for analysis. Samples, along with standards, blanks and duplicates included for quality assurance and quality control, were prepared and analyzed at SGS Canada Inc. or ALS Canada Ltd. laboratories. Samples are crushed to 90% or 95% less than 2mm. A 1kg riffle split is pulverized to >95% passing 106 microns or 85% passing 75 microns. 50g samples are analyzed by fire assay and AAS. At SGS, samples >10g/t Au are automatically analyzed by fire assay with gravimetric finish or screen metallic analysis. To test for coarse free gold and for additional quality assurance and quality control, Wallbridge requests screen metallic analysis for samples containing visible gold. These and future assay results may vary from time to time due to re-analysis for quality assurance and quality control.

The Qualified Person responsible for the technical content of this press release is Christopher Kelly, P.Geo., B.Sc., Project Geologist of Wallbridge.

About Wallbridge Mining

Wallbridge is currently advancing the exploration and development of its 100%-owned Fenelon Gold property, which is located along the Detour-Fenelon Gold Trend, an emerging gold belt in northwestern Québec with an ongoing, fully-funded 100,000-metre exploration drill program in 2020.

The recent acquisition of Balmoral Resources has secured for Wallbridge a buffer of several kilometres surrounding its rapidly expanding Fenelon discovery providing room for growth, as well as future mine development flexibility. This acquisition has also significantly expanded Wallbridge's land holdings in Québec along the Detour-Fenelon Gold Trend (from 10.5 km2 to over 900.0 km2), improving Wallbridge's potential for further discoveries for over 90-kilometre strike in this under-explored belt.

Wallbridge is also the operator of, and a shareholder in, Lonmin Canada Inc., a privately-held company with a large portfolio of nickel, copper, and platinum-group metals (PGM) projects in Ontario's Sudbury Basin.

This news release has been authorized by the undersigned on behalf of Wallbridge Mining Company Limited.

For further information please visit the Company's website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited

Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682-9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Investor Relations Advisor

Email: vvargas@wallbridgemining.com

This press release may contain certain “forward-looking statements” within the meaning of applicable Canadian securities legislation relating to, among other things, the operations of Wallbridge Mining Company Limited (“Wallbridge” or “Company”) and the environment within which it operates. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding future plans and objectives of Wallbridge, future opportunities and anticipated goals, the company’s portfolio, treasury, management team, timetable to mineral resource estimation, permitting and the prospective mineralization of the properties, are forward-looking statements that involve various risks, assumptions, estimates and uncertainties. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved”. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predicted outcomes could differ materially from those contained in such statements. These risks and uncertainties include, but are not limited to, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other required approval, the actual results of current exploration activities, fluctuations in prices of commodities, fluctuations in currency markets, actual results of additional exploration and development activities at the Company’s projects, capital expenditures, the availability of any additional capital required to advance projects, accidents, or pandemic interruptions.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. These statements reflect the current internal projections, expectations or beliefs of the Company and are based on information currently available to the Company.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws. The Company believe that the expectations reflected in those forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon by investors as actual results may vary.

Risks and uncertainties about Wallbridge’s business are more fully discussed in the disclosure material filed with the securities regulatory authorities in Canada and available on SEDAR under the Company’s profile at www.sedar.com. Readers are urged to read these materials and should not place undue reliance on the forward-looking statements contained in this press release.

Covid-19 - Given the rapidly evolving nature of the Coronavirus (COVID-19) pandemic, Wallbridge is actively monitoring the situation in order to continue to maintain as best as possible the activities while striving to protect the health of its personnel. Wallbridge' activities will continue to align with the guidance provided by local, provincial and federal authorities in Canada. The company has established measures to continue normal activities while protecting the health of its employees and stakeholders. Depending on the evolution of the virus, measures may affect the regular operations of Wallbridge and the participation of staff members in events inside or outside Canada.

Communiqués

Abonnez-vous pour recevoir des nouvelles

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Titre du poste | Statut | Lieu |

|---|---|---|

| Géologue Sénior | Horaire 14-14 | Fenelon |