- Accueil

- Qui nous sommes

- Nos projets

- Investisseurs

- Aperçu

- Informations sur les actions

- Présentations

- Événements et webdiffusions

- Rapports et états financiers

- Couverture des analystes

- Assemblée des actionnaires

- Assemblée extraordinaire des actionnaires en vue d’approuver le remboursement de capital provenant de l’opération de scission avec Archer Exploration Corp.

- Médias et articles

- Dépôts SEDAR+

- Investisseurs américains - PFIC

- Communiqués

- Développement durable

- Nous joindre

- EN

Wallbridge Enters into Term Sheet with Kirkland Lake Gold on Joint Venture of the Detour East Property

Company to Focus on Expanding Fenelon Gold System

Toronto, Ontario – September 14, 2020 – Wallbridge Mining Company Limited (TSX:WM) ("Wallbridge" or the "Company") today announced that it has entered into a non-binding term sheet (the "Term Sheet") with respect to a joint venture of its Detour East gold property ("Detour East" or the "Property") with Kirkland Lake Gold Ltd. (TSX:KL) ("Kirkland"). Under terms of this joint venture, Kirkland can earn a 75% interest in Detour East by making expenditures totalling $35 million on the Property, as described below.

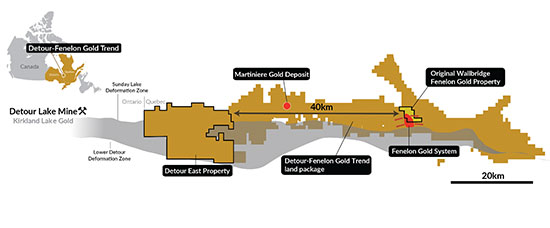

"This Term Sheet, and ultimate joint venture agreement, is strategic for Wallbridge as it allows the Company to focus on fully-defining the size potential of our 100% owned Fenelon Gold property ("Fenelon") while at the same time advancing exploration on Detour East located at the far west end of the very large land position Wallbridge acquired through its acquisition of Balmoral Resources Ltd. ("Balmoral")," stated Marz Kord, President & CEO of Wallbridge. "The acquisition of Balmoral was primarily motivated by our belief that the Fenelon Gold system was larger than had been defined at that time, and that it extended onto Balmoral's ground immediately adjacent to our original Fenelon Gold property. This belief has now been confirmed by our initial drill results west and south of Fenelon (see press release dated September 8, 2020) and will be our immediate exploration focus. In addition, numerous other high priority targets on other areas of the recently acquired Balmoral ground, including the area around the Martinière deposit, also deserve exploration which Wallbridge will evaluate over the coming months. Entering into a joint venture with Kirkland on the Detour East will allow us to focus on the Fenelon gold system, and will bring us a high-quality partner with excellent knowledge of the regional geology through its Detour Lake operations, located adjacent to Detour East."

Under the terms of the Term Sheet, Wallbridge will grant Kirkland the option to acquire up to an undivided 50% interest in the Property by funding phase 1 expenditures of $7.5 million over five (5) years (the "Phase 1 Expenditures") with a minimum commitment of $2.0 million in the first two years ($0.5 million by the first anniversary and $1.5 million by the second anniversary of entering into a definitive joint venture agreement) (the "Option"). During the Option period, Kirkland shall have the right to act as Operator of the Property.

Upon satisfaction of the Option, Wallbridge and Kirkland shall have formed a joint venture (the "Joint Venture") on Detour East with Kirkland acting as the operator of the Joint Venture (the "Operator") to carry on operations with respect to the Property.

Upon the formation of the Joint Venture, Kirkland will hold the right to acquire an additional 25% interest in the Property by incurring additional expenditures of $27.5 million within the first five (5) years of the formation of the Joint Venture ("Second Stage Option Period").

Upon Kirkland having incurred additional expenditures of $27.5 million during the Second Stage Option Period, Kirkland shall have earned an undivided 75% interest in the Property. The deemed expenditures on the property shall be Kirkland ($35,000,000) and Wallbridge ($11,666,667). Following the completion of the Second Stage Option Period, any additional funds required will be contributed by the Joint Venture parties based on their then proportional joint venture interests. Should either Wallbridge or Kirkland (each a "Party" and collectively the "Parties") elect not to fund a program, its Joint Venture interest will be diluted pro-rata. If a Party commits to fund a program, and fails to contribute its share of the funding, that Party's Joint Venture interest will be diluted at three times the pro-rata rate.

If either Party's Joint Venture interest is reduced to 5% or less, that Party's Joint Venture interest shall be automatically converted to a 1% net smelter return royalty (the "NSR") and the Joint Venture shall be automatically terminated. The surviving Party shall have a right of first offer with respect to the purchase or sale of the NSR by the non-surviving party.

Prior to September 30, 2020, the Parties shall diligently and in good faith negotiate and enter into a definitive option agreement including customary representations, warranties and conditions. In addition to the entering into of definitive agreements, completion of the transaction is conditional upon receipt of all required consents and regulatory approvals including the approval of the respective Board of Directors of each party.

Figure 1. Regional Map of Wallbridge's Land Package on the Detour-Fenelon Gold Trend

About Wallbridge Mining

Wallbridge is establishing a pipeline of projects that will support sustainable 100,000 ounce-plus annual gold production as well as organic growth through exploration and scalability.

Wallbridge is currently advancing the exploration and development of its 100%-owned Fenelon Gold Property, which is located along the Detour-Fenelon Gold Trend, an emerging gold belt in northwestern Québec with an ongoing, fully funded 100,000-metre exploration drill program in 2020.

As announced on May 22, 2020, Wallbridge has completed the Plan of Arrangement whereby Wallbridge acquired all of the issued and outstanding shares of Balmoral, in an all-stock transaction. The Balmoral transaction secures for Wallbridge a buffer of several kilometres surrounding its rapidly expanding Fenelon discovery providing room for growth, as well as future mine development flexibility. The transaction, along with a recent option agreement signed with Midland Exploration, also significantly expands Wallbridge's land holdings in Québec along the Detour-Fenelon Gold Trend (from 10.5 km2 to over 900.0 km2), improving Wallbridge's potential for further discoveries in this under-explored belt.

Wallbridge is also pursuing additional advanced-stage projects which would add to Wallbridge's near-term project pipeline. Wallbridge is also the operator of, and a 17.8% shareholder in, Lonmin Canada Inc., a privately-held company with a large portfolio of nickel, copper, and platinum-group metals (PGM) projects in Ontario's Sudbury Basin.

For further information please visit Wallbridge's website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited

Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682-9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Investor Relations Advisor

Email: vvargas@wallbridgemining.com

This press release may contain forward-looking statements (including "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of the US Private Securities Litigation Reform Act of 1995) relating to, among other things, the operations of Wallbridge and the environment in which it operates. Generally, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Wallbridge has relied on a number of assumptions and estimates in making such forward-looking statements, including, without limitation, the costs associated with the development and operation of its properties. Such assumptions and estimates are made in light of the trends and conditions that are considered to be relevant and reasonable based on information available and the circumstances existing at this time. A number of risk factors may cause actual results, level of activity, performance or outcomes of such exploration and/or mine development to be materially different from those expressed or implied by such forward-looking statements including, without limitation, whether such discoveries will result in commercially viable quantities of such mineralized materials, the possibility of changes to project parameters as plans continue to be refined, the ability to execute planned exploration and future drilling programs, the need for additional funding to continue exploration and development efforts, changes in general economic, market and business conditions, and those other risks set forth in Wallbridge's most recent annual information form under the heading "Risk Factors" and in its other public filings. Forward-looking statements are not guarantees of future performance and such information is inherently subject to known and unknown risks, uncertainties and other factors that are difficult to predict and may be beyond the control of Wallbridge. Although Wallbridge has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. Consequently, undue reliance should not be placed on such forward-looking statements. In addition, all forward-looking statements in this press release are given as of the date hereof.

Wallbridge disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws. The forward-looking statements contained herein are expressly qualified by this disclaimer.

Communiqués

Abonnez-vous pour recevoir des nouvelles

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Titre du poste | Statut | Lieu |

|---|---|---|

| Géologue Sénior | Horaire 14-14 | Fenelon |