- Accueil

- Qui nous sommes

- Nos projets

- Investisseurs

- Aperçu

- Informations sur les actions

- Présentations

- Événements et webdiffusions

- Rapports et états financiers

- Couverture des analystes

- Assemblée des actionnaires

- Assemblée extraordinaire des actionnaires en vue d’approuver le remboursement de capital provenant de l’opération de scission avec Archer Exploration Corp.

- Médias et articles

- Dépôts SEDAR+

- Investisseurs américains - PFIC

- Communiqués

- Développement durable

- Nous joindre

- EN

Wallbridge Expands Ripley Zone, Mobilizes Drill to Further Test Gold Potential along Sunday Lake Deformation Zone

Toronto, Ontario – February 28, 2023 – Wallbridge Mining Company Limited (TSX:WM, OTCQX:WLBMF) (“Wallbridge” or the “Company”) is pleased to report additional results from its 2022 drilling program at the Company’s 100%-owned Fenelon gold project (“Fenelon”) that have expanded the satellite Ripley Zone towards the southwest. In addition, new prospective targets have been identified along the Sunday Lake Deformation Zone (“SLDZ”).

Following a two-month pause in drilling, two rigs were deployed in early February to commence exploration drilling in the vicinity of the Fenelon gold deposit; a third drill has now been mobilized to test newly identified gold targets along the SLDZ.

“Building on the multi-million-ounce resource we have already established at Fenelon and Martiniere, our 2023 exploration program is targeting the discovery of new gold zones on the Company’s highly prospective Detour-Fenelon Gold Trend land package,” said Attila Péntek, Wallbridge’s Vice President, Exploration. “Positive drill results at Ripley, a satellite zone located one kilometre south of the main Fenelon deposit, reinforce the potential for further discoveries along the SLDZ, which remains largely untested towards the east and west. The upcoming drill program will focus on testing extensions of the main host rocks and structures that control known gold mineralized trends in this region using large-spaced drill step-outs.”

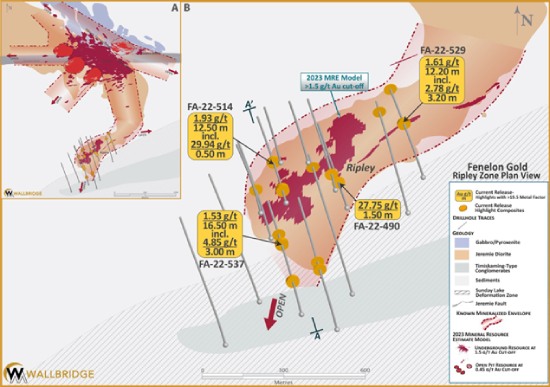

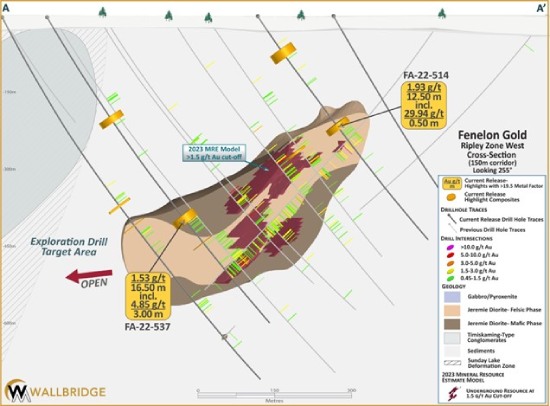

Results reported today (Table 1) successfully expanded the Ripley zone to the southwest and support the potential for further gold mineralization along the SLDZ. These new drill results and geological interpretation indicate potential folding of the host rocks immediately south of the Ripley Zone, providing a high-priority drill target.

Ripley Zone Highlight Assay Results

| FA-22-490 | 27.75 g/t Au over 1.50 metres, |

| FA-22-514 | 1.93 g/t Au over 12.50 metres, including |

| 29.94 g/t Au over 0.50 metre; | |

| FA-22-537 | 1.53 g/t Au over 16.50 metres, including |

| 4.85 g/t Au over 3.00 metres; | |

| FA-22-529 | 1.61 g/t Au over 12.20 metres, including |

| 2.87 g/t Au over 3.20 metres; |

About the Ripley Zone

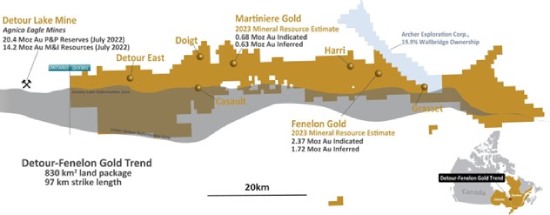

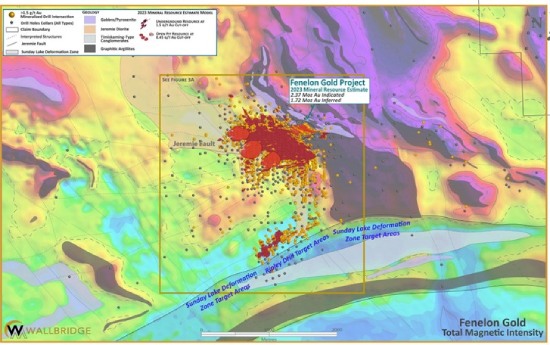

The Ripley Zone straddles the northern contact of the SLDZ, in contrast to the main Fenelon deposit, which is located along the Jeremie Fault, a secondary splay of the SLDZ (see Figure 1). Agnico’s Detour Lake Mine is also located along the northern edge of the SLDZ, emphasizing the importance of this structural horizon.

Sporadic gold mineralization was first discovered at Ripley in the summer of 2019, following up on the discovery of the Fenelon Area 51 and Tabasco/Cayenne Zones. The drilling program conducted by Wallbridge in 2021-22 further delineated the mineralized footprint of the Ripley Zone. Systematic drilling also revealed the continuity and pervasive nature of the gold mineralization.

The gold-bearing system at Ripley has now been traced for a lateral distance of over 750 metres, and has only been tested down to a vertical depth of approximately 500 metres. Exploration potential remains open in most directions, both laterally and at depth.

Important geological observations at Ripley also include the spatial proximity of gold mineralization with Timiskaming-type sedimentary rocks. In the Southern Abitibi, such units are known to provide excellent markers for structures that acted as mineralizing gold fluid pathways (e.g., Timmins and Kirkland Lake gold camps). This new information will be useful to define additional prospective targets regionally.

2023 Drill Program

Very limited historic drill testing was conducted along the SLDZ outside a 1.5 kilometre strike length corridor centered on the Ripley Zone (see Figure 2). Several targets were identified within a few kilometres of the Ripley Zone that, based on geology and geophysics, are interpreted to be favorable for the deposition of gold mineralization.

Wallbridge’s 2023 drilling strategy will aim to evaluate the extensions of known mineralized zones using large-spaced step-outs. In addition, exploration drilling along the SLDZ will focus on conceptual targets, including the potential folding of the Jeremie diorite intrusion immediately south of the Ripley Zone.

The results reported in today’s press release are from 14 drill holes completed in 2022. All figures and a table with drill hole information of recently completed holes are posted on the Company’s website under “Current Program” at https://wallbridgemining.com/our-projects/fenelon-gold/.

Figure 1. Detour-Fenelon Gold Trend

Figure 2. Fenelon Gold, Total Magnetic Intensity and Geology

Figure 3. Fenelon Gold. A) Fenelon Plan View and B) Ripley Zone Plan View

Figure 4. Ripley Zone West, Cross-Section, 150-metre corridor

Table 1. Recent Drill Assay Highlights for Ripley Zone (1)

| Drill Hole | From | To | Length | Au | Au Cut(2) | VG(3) | Zone/Corridor |

|---|---|---|---|---|---|---|---|

| (m) | (m) | (m) | (g/t) | (g/t) | |||

| RIPLEY | |||||||

| FA-22-490 | 197.50 | 199.00 | 1.50 | 27.75 | 27.75 | Ripley | |

| FA-22-512 | 634.60 | 636.00 | 1.40 | 9.67 | 9.67 | Ripley | |

| FA-22-514 | 78.00 | 97.00 | 19.00 | 0.56 | 0.56 | Ripley | |

| FA-22-514 | 258.50 | 271.00 | 12.50 | 1.93 | 1.93 | VG | Ripley |

| Including… | 261.20 | 261.70 | 0.50 | 29.94 | 29.94 | VG | Ripley |

| FA-22-516 | No Significant Mineralization (4) | Ripley | |||||

| FA-22-519 | 108.70 | 110.90 | 2.20 | 3.92 | 3.92 | Ripley | |

| FA-22-522 | No Significant Mineralization (4) | Ripley | |||||

| FA-22-525 | 817.50 | 819.00 | 1.50 | 6.23 | 6.23 | Ripley | |

| FA-22-527 | 430.00 | 434.50 | 4.50 | 1.56 | 1.56 | Ripley | |

| FA-22-527 | 479.50 | 481.00 | 1.50 | 7.32 | 7.32 | Ripley | |

| FA-22-528 | 319.50 | 324.00 | 4.50 | 1.49 | 1.49 | Ripley | |

| FA-22-529 | 376.00 | 388.20 | 12.20 | 1.61 | 1.61 | Ripley | |

| Including… | 385.00 | 388.20 | 3.20 | 2.78 | 2.78 | Ripley | |

| FA-22-529 | 596.50 | 598.00 | 1.50 | 3.92 | 3.92 | Ripley | |

| FA-22-533 | No Significant Mineralization (4) | Ripley | |||||

| FA-22-534 | No Significant Mineralization (4) | Ripley | |||||

| FA-22-537 | 228.00 | 241.50 | 13.50 | 0.45 | 0.45 | Ripley | |

| FA-22-537 | 466.50 | 483.00 | 16.50 | 1.53 | 1.53 | Ripley | |

| Including… | 475.50 | 478.50 | 3.00 | 4.85 | 4.85 | Ripley | |

| FA-22-537 | 532.70 | 533.55 | 0.85 | 7.35 | 7.35 | Ripley | |

| FA-22-538 | No Significant Mineralization (4) | Ripley | |||||

| (1) Table includes only assay results received since the latest press release dated December 8, 2022. | |||||||

| (2) Au cut at: 75 g/t Au for the Ripley Zone. | |||||||

| (3) Intervals containing visible gold ("VG"). | |||||||

| (4) Metal factor of at least 5 g/t*m and minimum weighted average composite grade of 0.45 g/t Au within the 2023 MRE open pit shell and 1.5 g/t Au for outside open pit shell. | |||||||

| Note: True widths are estimated to be 50-80% of the reported core length intervals. | |||||||

Assay QA/QC and Qualified Persons

Drill core samples from the ongoing drill program at Fenelon are cut and bagged either on-site or by contractors and transported to SGS Canada Inc. or Bureau Veritas Commodities Canada Ltd. for analysis. Samples, standards and blanks are included for quality assurance and quality control, were prepared and analyzed at the laboratories. Samples are crushed to 90% less than 2mm. A 1kg riffle split is pulverized to 85% passing 75 microns. 50g samples are analyzed by fire assay and AAS or ICP. At SGS and Bureau Veritas, samples >10g/t Au are automatically analyzed by fire assay with gravimetric finish or screen metallic analysis. To test for coarse free gold and additional quality assurance and quality control, Wallbridge requests screen metallic analysis for samples containing visible gold. These and future assay results may vary from time to time due to re-analysis for quality assurance and quality control.

The Qualified Person responsible for the technical content of this press release is Lucas Briao Koth, M.Sc., P.Geo., Senior Project Geologist of Wallbridge.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects along the Detour-Fenelon Gold Trend while respecting the environment and communities where it operates.

Wallbridge’s flagship project, Fenelon Gold (“Fenelon”), is located on the highly prospective Detour-Fenelon Gold Trend Property in Québec’s Northern Abitibi region. An updated mineral resource estimate completed in January 2023 yielded significantly improved grades and additional ounces at the 100%-owned Fenelon and Martiniere properties, incorporating a combined 3.05 million ounces of Indicated gold resources and 2.35 million ounces of Inferred gold resources. Fenelon and Martiniere are located within an approximate 830 km2 exploration land package controlled by Wallbridge. The Company believes that these two deposits have good potential for economic development, especially given their proximity to existing hydro-electric power and transportation infrastructure. In addition, Wallbridge believes that the extensive land package is extremely prospective for the discovery of additional gold deposits.

Wallbridge also holds a 19.9% interest in the common shares of Archer Exploration Corp. (“Archer”) as a result of the sale of the Company’s portfolio of nickel assets in Ontario and Québec in November of 2022.

Wallbridge will continue to focus on its core Detour-Fenelon Gold Trend Property while enabling shareholders to participate in the potential economic upside in Archer.

For further information please visit the Company’s website at www.wallbridgemining.com or contact:

Wallbridge Mining Company Limited Marz Kord, P. Eng., M. Sc., MBA

President & CEO

Tel: (705) 682‒9297 ext. 251

Email: mkord@wallbridgemining.com

Victoria Vargas, B.Sc. (Hon.) Economics, MBA

Investor Relations Advisor

Email: vvargas@wallbridgemining.com

Cautionary Note Regarding Forward-Looking Information

This press release contains forward-looking statements or information (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections, and interpretations as at the date of this press release.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI herein includes, but is not limited to, statements regarding the potential future performance of Archer common shares, future drill results; the Company’s ability to convert inferred resources into measured and indicated resources; environmental matters; stakeholder engagement and relationships; parameters and methods used to estimate the mineral resource estimates (each an “MRE”) at the Fenelon and Martiniere properties (collectively the “Deposits”); the prospects, if any, of the Deposits; future drilling at the Deposits; and the significance of historic exploration activities and results.

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Assumptions upon which FLI is based, without limitation, include the results of exploration activities, the Company’s financial position and general economic conditions; the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Deposits; the accuracy of key assumptions, parameters or methods used to estimate the MREs; the ability of the Company to obtain required approvals; the evolution of the global economic climate; metal prices; environmental expectations; community and non-governmental actions; any impacts of COVID-19 on the Deposits; and, the Company’s ability to secure required funding. Risks and uncertainties about Wallbridge's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com.

Information Concerning Estimates of Mineral Resources

The disclosure in this press release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used in this

press release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained in this press release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced in this press release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Communiqués

Abonnez-vous pour recevoir des nouvelles

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Titre du poste | Statut | Lieu |

|---|---|---|

| Géologue Sénior | Horaire 14-14 | Fenelon |