Press

Releases

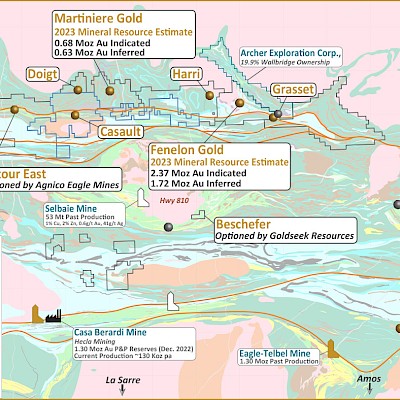

Grasset Gold, Québec, Canada

Project Snapshot

| Status: | Early exploration stage |

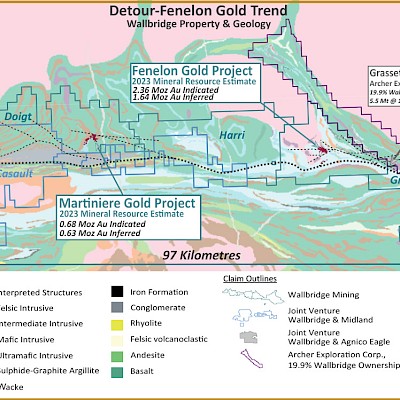

| Location: | Detour Fenelon Gold Trend |

| Commodity: | Gold |

| Ownership: | 100% Wallbridge |

| Current exploration activities: | First drill program of 10,750 metres, testing the Grasset East Flexure target area was completed in 2023, identifying multiple grassroots gold occurrences under deep glacial overburden cover a 5 km strike length. Continued drill testing of grassroots targets on this property, with approximately 3,600 m is planned for 2024. |

| Mineral resources: | None |

- Overview

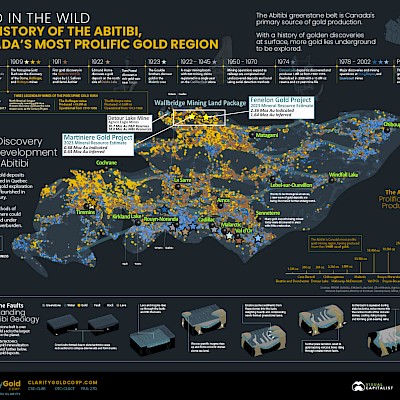

The Grasset Gold property is part of Wallbridge’s 830 km2 Detour-Fenelon Gold Trend land package. It is located adjacent to the Fenelon Gold project (100% Wallbridge), Archer Exploration’s Grasset Nickel project (19.9% Wallbridge) and approximately 50 kilometres west-northwest of Matagami, Québec.

Grasset Gold covers approximately 20 kilometres of the SLDZ and to the east covers a portion of the Lower Detour Deformation Zone (“LDDZ”) as well.

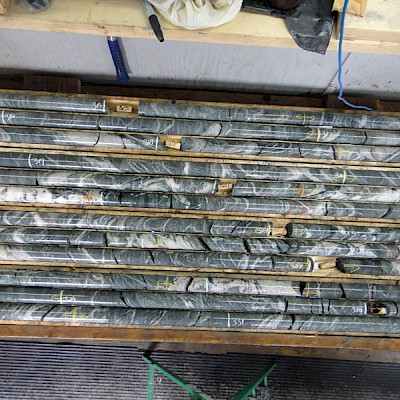

Gold mineralization was intersected on the Grasset project, both within the regional-scale SLDZ which transects the project and within secondary structures marginal to the Grasset Ultramafic Complex. Significant discoveries include the Grasset Gold Zone with an intercept of 1.6 g/t Au over 33.0 m, including 6.15 g/t Au over 4.04 m and the recently discovered Hinge Zone in the Grasset East Flexure area.

Maps & Images (click to enlarge)

- Current Program

The 2023 Grasset Gold exploration program predominantly focused on the intersection of a large fold-structure with a flexure in the SLDZ, the main structure controlling gold mineralization along the Detour-Fenelon Gold Trend.

The Grasset East Flexure target area consists of a large conglomerate-wacke basin (Timiskaming-like) in contact with a thick sequence of mafic volcanic rocks. In the southern Abitibi, Timiskaming-type sedimentary units are generally associated with regional-scale fault zones that acted as the main ore-fluid pathways (Timmins and Kirkland Lake camps).

The 2023 drill program was designed to define the geological framework of the Grasset East Flexure target area, and to test structures interpreted from recently collected high-resolution airborne magnetic data. Two main types of environments are targeted:

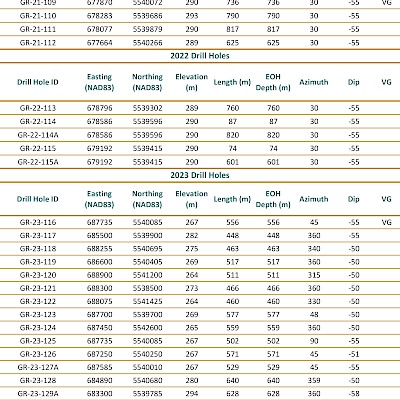

- Northern contact of Timiskaming-like sedimentary unit with mafic volcanic rocks in areas of interpreted structural complexities (16 drill holes completed – targets G1, G2, G5, G6, G7 and G11); and,

- Interpreted structures and lithological contacts within the northern mafic volcanic package (4 drill holes completed – targets G3, G8, G9 and G10).

The Grasset East Flexure target area was never drill tested in the past. Originally, the Company intended to complete approximately 5,000 metres of diamond drilling on 11 targets over an area of 4.5 kilometres by 3.5 kilometres (see Wallbridge release dated August 24, 2023).

To further investigate this new mineralized area, the size of this inaugural drill program was increased to approximately 10,750 metres in 20 drill holes, testing 10 of the originally identified 11 targets.

In 2024, the Company is planning approximately 3,600 metres of follow-up drilling and testing of new grassroots targets.

Maps & Images (click to enlarge)

- Brief History

Exploration on the Grasset Gold project had been very limited prior to the acquisition of the property by Balmoral Resources Ltd. (“Balmoral”). The earliest reported mineral discovery is a quartz-vein hosted gold showing located on the southwestern shore of Lac Grasset where grab samples returned a high of 5.55 g/t Au. Four holes were drilled in the vicinity of this discovery in 1957 but no anomalous gold values were reported. All work during the late 1950’s and late 1970’s focused on drill testing of magnetic or conductive features in the search for VMS-type copper-zinc deposits, like the nearby Matagami and Selbaie mines.

In the late 1990’s, Fairstar Exploration tested two conductors on the northeastern portion of the property with one of these two holes intersecting a narrow quartz vein with strongly elevated silver values (209 g/t Ag over 0.30 m).

Work in 2006 by a previous operator identified nickel-copper-PGM mineralization at the northern end of the southern segment of the GUC.

Balmoral acquired the Grasset property in 2010. In 2011, they carried out a drilling program of 5 holes totaling 1,728 metres and discovered the Grasset Gold Zone with an intercept of 1.6 g/t Au over 33.0 m, including 6.15 g/t Au over 4.04 m, along the SLDZ. In 2012, they completed 7 holes totaling 1,899 metres and discovered a new nickel-copper-PGM system within the basal portion of a largely untested sequence of ultramafic rocks (GUC) on the property, the first of its kind recognized in the belt (~8.3 kilometres southeast of the occurrence identified in 2006 and 1 kilometre east of the Grasset Gold Zone). Discovery hole GR-12-09 intersected a 10 metre wide zone of disseminated pyrrhotite, pentlandite and minor chalcopyrite mineralization which returned an intercept of 0.51% Ni, 0.09% Cu, 0.15 g/t Pt and 0.33 g/t Pd over 9.17 m, including a high-grade interval of 1.34% Ni, 0.17% Cu, 0.16 g/t Pt and 0.54 g/t Pd over 0.4 m.

The winter 2014 program (11 holes totaling 3,634 metres) was successful in delineating at least three Ni-Cu-PGM mineralized horizons in the GUC and was consequently followed up with a 51-hole drill program totaling 16,673 metres. The bulk of the high-grade mineralization is in the upper of these three horizons (H3 Zone). The H3 Zone discovery hole GR-14-25 returned 45.28 m grading 1.78% Ni, 0.19% Cu, and 0.42 g/t Pt.

The 2015 drilling program (39 holes totaling 16,801 metres) continued to intersect broad zones of disseminated nickel-copper-PGM sulphide mineralization, extending the scale of the mineralized system and provided sufficient information to perform an initial resource estimate for the Ni-Cu-PGM Grasset deposit. In late 2015, Balmoral completed 12 exploration holes totaling 3,236 metres outside of the Grasset deposit.

An initial resource estimate and preliminary metallurgical testing results were published in March 2016 and all exploration activity ceased (prompted by low nickel prices) with the deposit remaining open to depth and along strike to the northwest.

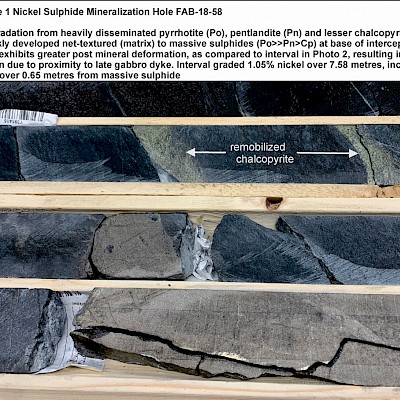

Balmoral carried out a drilling program in 2018 and 2019 in the area 7 kilometres northwest of the Grasset nickel deposit within a high-level intrusive portion of the GUC (area referred to as the Central GUC area; prior drilling in 2015 by Balmoral with nickel mineralization identified in 2006). The drilling intersected both high grade and broader zones on nickel mineralization. The best high-grade intercepts included 7.58 m grading 1.05% Ni, 0.31% Cu, 0.05% Co, 0.20 g/t Pt and 0.48 g/t Pd (FAB-18-58). Broad zones of mineralization included: 112.85 m grading 0.27% Ni and 0.013% Co (beginning at <200 m below surface) (FAB-19-61) and 120.57 m grading 0.26% Ni and 0.012% Co (FAB-18-54).

- Geology and Mineralization

Between November 2021 and February 2022, Wallbridge carried out exploration drilling 10 kilometres south-east of the Fenelon deposit, to follow-up on the Grasset Gold showing, where historic intersections include 1.66 g/t Au over 33 metres, with higher grade sub-intervals, such as 6.15 g/t Au over 4.04 metres.

One of the first drill holes of the program, GR-21-109 intersected sulfide-bearing quartz-carbonate veining containing visible gold, assaying 42.63 g/t Au over 0.50 metre. Gold mineralization in this area is hosted by gabbroic intrusive host rocks adjacent to the Sunday Lake Deformation Zone (“SLDZ”), which has an associated unit of thick polymictic conglomerates and is represented by strong brittle-ductile deformation zones. Another drill hole, FA-21-328, testing interpreted structures adjacent to the SLDZ, discovered new gold mineralization with assay results up to 9.98 g/t Au over 0.60 metre.

The geology and orientation of the deformation zones in these holes is similar to the Fenelon gold deposit, and analogous to other well-known gold deposits in the southern Abitibi. Given this very favorable environment for hosting gold mineralization, the Company will continue to explore for new gold zones that may have synergies with a future operation at Fenelon.

Maps & Images (click to enlarge)

- Current Program

Sign Up for News

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Position Title | Status | Location |

|---|---|---|

| Senior Geologist | Schedule 14-14 | Fenelon |