Fenelon Gold Project, Québec, Canada

PEA WEBCAST

Wallbridge conducted a webinar to discuss Fenelon's positive PEA results.

Date and Time: Tuesday, JUNE 27, 2023 @ 10:00 AM EDT

Watch Now: https://youtu.be/bTQB0SCSL-o

Project Snapshot

| Status: | Advanced exploration stage (defined mineral resources) |

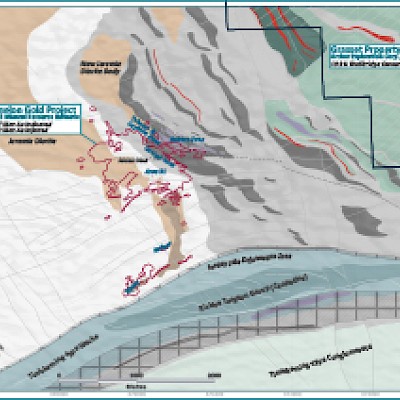

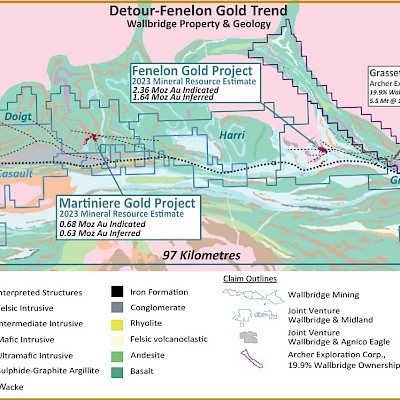

| Location: | Detour-Fenelon Gold Trend, ~80 km east of Detour Lake gold mine (Agnico Eagle Mines) |

| Commodity: | Gold |

| Ownership: | 100% Wallbridge |

| Current exploration activities: | Wallbridge has drilled over 456,000 metres from 2017 to 2024. In 2025, the company plans to drill approximately 2,000 metres at Fenelon and conduct an outcrop stripping program north of the Fenelon Mine. |

| Mineral resources: | 1.75 million gold ounces of indicated and 1.65 million gold ounces of inferred mineral resources. |

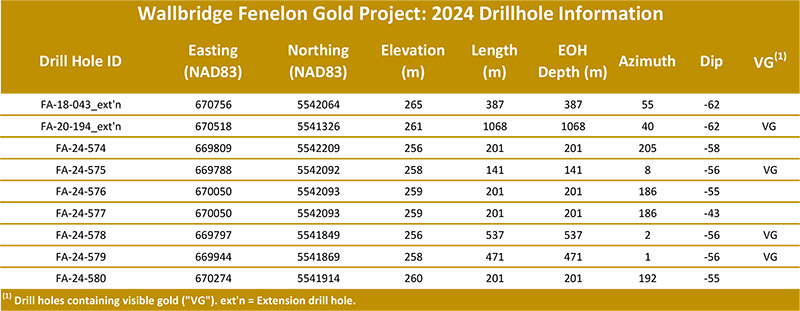

In 2024, Wallbridge is planning to complete approximately 5,000 metres of exploration drilling focusing on testing gold mineralization in the vicinity of the PEA mine design where there is potential to improve the project’s overall economics.

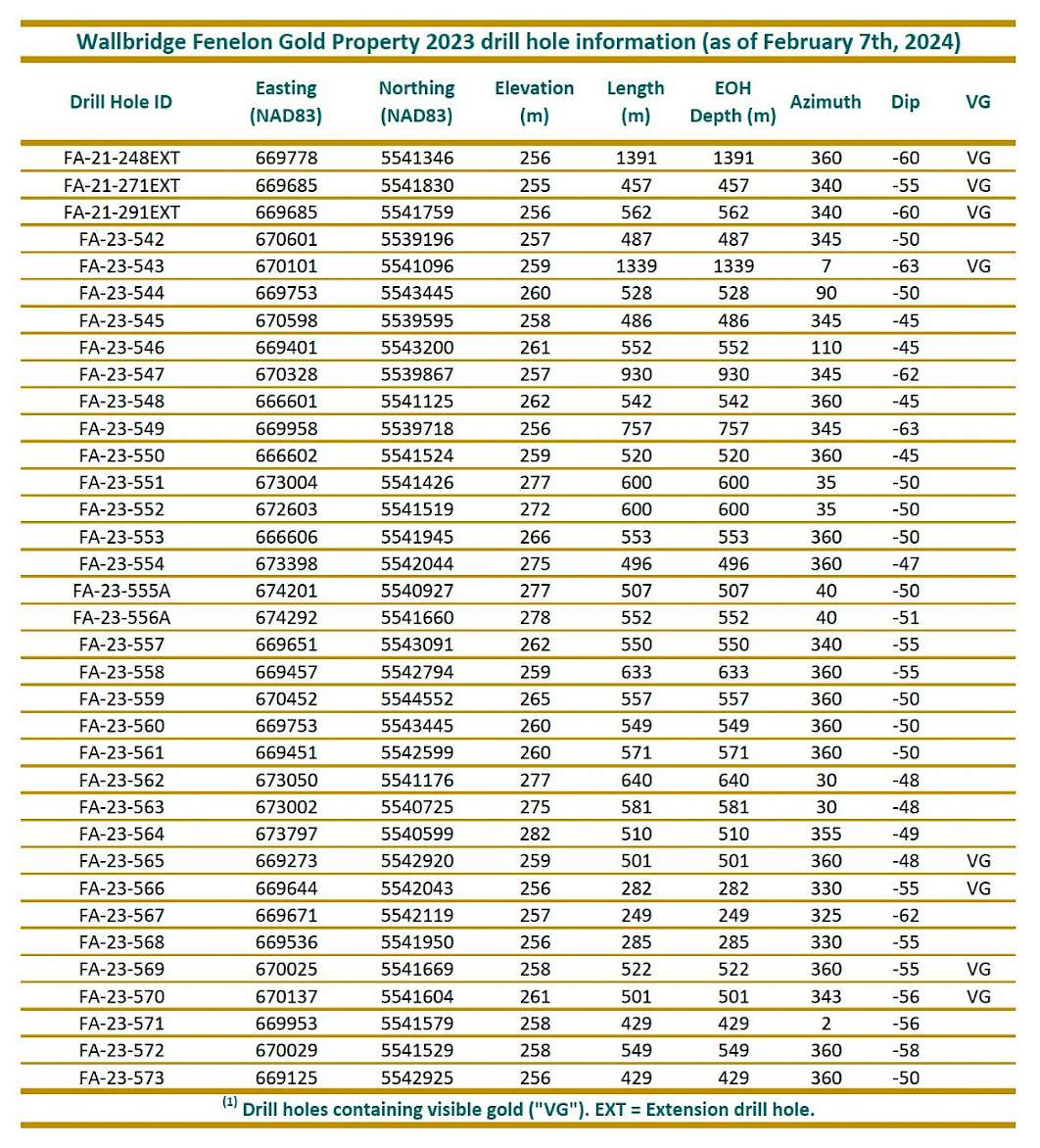

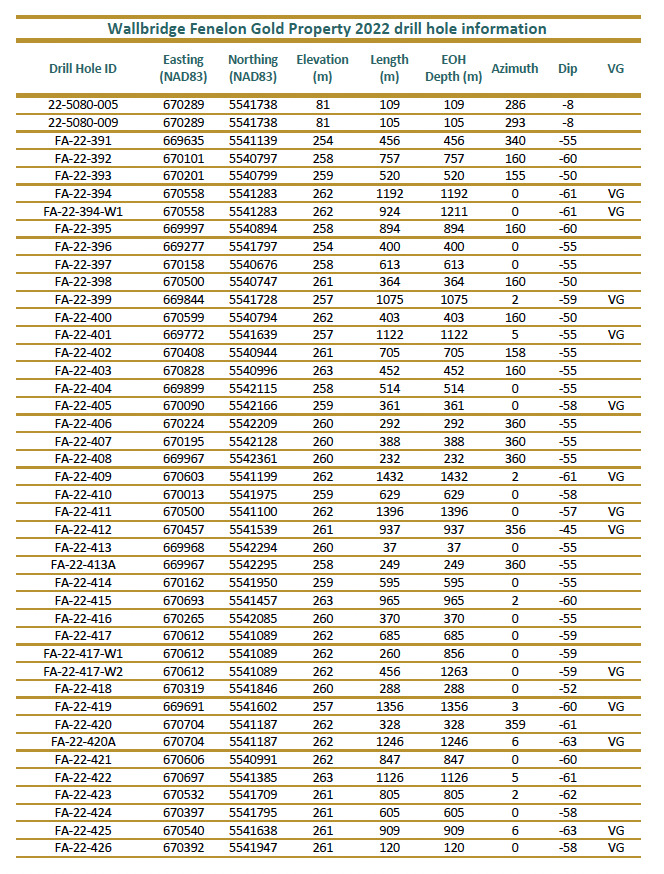

Close to 20,000 metres of exploration drilling completed in 2023 and approximately 115,000 metres of drilling completed in 2022

- Overview

Fenelon is located in the Nord-du-Québec administrative region, approximately 75 km west-northwest of the town of Matagami, in the province of Québec, Canada. In May 2020, Wallbridge acquired significant property adjacent to Fenelon from Balmoral. Wallbridge owns a 100% undivided interest in the acquired surrounding properties.

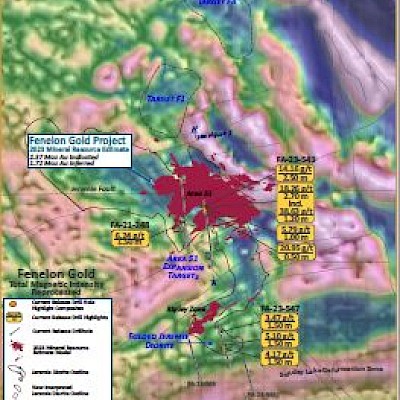

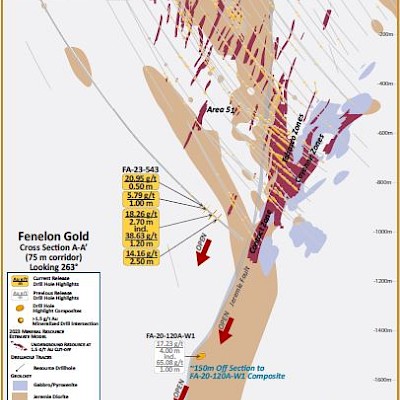

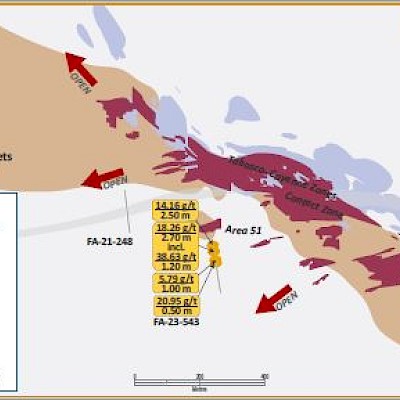

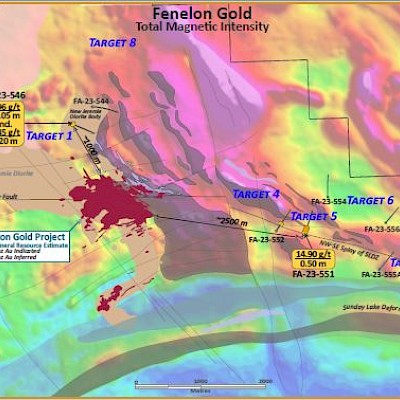

Since the acquisition of the original Fenelon property in 2016, Wallbridge has completed over 450,000 m of surface and underground drilling and underground bulk sampling at Fenelon as of December 31, 2023. The drill programs have successfully expanded the footprint of the Fenelon mineralized system along strike and at depth, including the new discoveries within the Area 51 and Lower Tabasco-Cayenne zones.

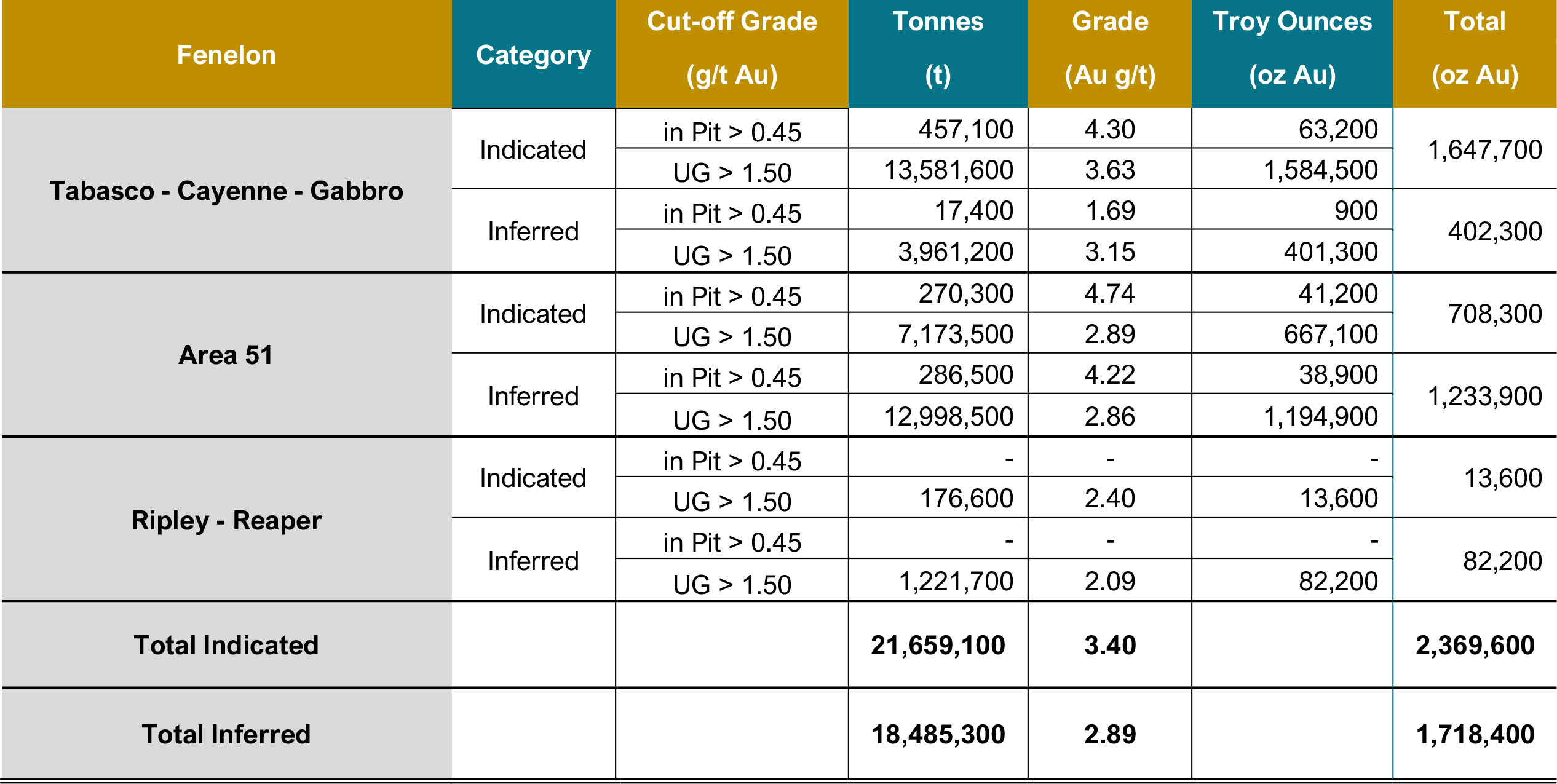

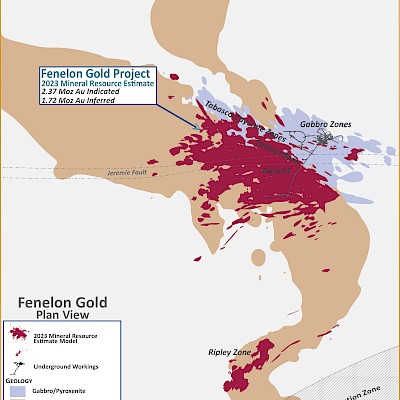

The 2023 Fenelon MRE includes 2.37 million ounces of indicated gold resources and 1.72 million ounces of inferred gold resources, representing a significant increase in gold grade and a modest increase in contained ounces compared to the 2021 MRE.

On June 26, 2023, the Company announced positive results from the Preliminary Economic Study (“PEA”) completed on Fenelon. The 2023 MRE formed the foundation for the PEA which assessed the potential for a predominantly underground bulk mining operation at Fenelon. The Company cautions that the results of the PEA are forward-looking and preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them to be classified as mineral reserves. There is no certainty that the results of the PEA will be realized. The PEA financial economic analysis is significantly influenced by gold prices. The following summary includes certain non-IFRS financial measures, such as free cash flow, initial capital expenditures, sustaining capital expenditures, total cash costs and all in sustaining costs, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. The disclosure of such non-IFRS financial measures is required under National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and has been prepared in accordance with NI 43-101. Although reconciliations to equivalent historical measures are not available. Please refer to the cautionary language and non-IFRS financial measures at the end of this MD&A (pages 24 to 25) for detailed definitions and descriptions of such measures.

PEA Summary: Average annual gold production of 212,000 oz over 12 years with peak year production of 240,000 ounces Average annual free cash flow of $157 million over life of mine (“LOM”) with total taxes payable at the base case gold price of $792 million After-tax Net Present Value (“NPV”) of $721 million at base case gold price of US$1,750 and $C/US$ of 1.30 using 5% discount rate and an after-tax Internal Rate of Return (“IRR”) of 18% After-tax NPV of $1,070 million at spot gold price of US$1,950 and $C/US$ of 1.34 and an after-tax IRR of 24% with a payback period of 4.20 years from the commencement of production Initial capital expenditures of $645 million including a contingency of $54 million Sustaining capital expenditures of $594 million including a contingency of $44 million Total cash costs of US$749/oz including the 4% royalties All in sustaining costs of US$924/oz For further details on the results of the PEA at Fenelon, refer to the press release dated June 26, 2023 available at www.wallbridgemining.com. The NI 43-101 technical report was filed on www.sedarplus.com and the Company’s website on August 10, 2023. The PEA summarized above is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of inferred mineral resources. Inferred mineral resources are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no guarantee that inferred mineral resources can be converted to indicated or measured mineral resources, and as such, there is no guarantee the project economics described herein will be achieved.

- Current Program

The 5,000 metres of drilling planned for Fenelon in 2024 is mainly designed to test gold mineralization in the vicinity of the PEA mine design where there is potential to improve the project’s overall economics.

Several technical studies are also planned in 2024 at Fenelon with the goal of further enhancing the economics of the project.

- Brief History

Gold mineralization on the Fenelon Gold property was first intersected by Cyprus Canada in 1988. The Discovery Zone (now referred as Main Gabbro Zones) was discovered in 1994. In 1997, Cyprus and Fairstar reported a resource (uncategorized) of 252,000 tonnes at 14.2 g/t Au for a total of 115,000 ounces of gold1. In 1998, International Taurus Resources Inc. ("Taurus") acquired Cyprus’ interest in the joint venture. Between 1998 and 2004, the following advanced exploration activities were conducted on the Discovery Zone:

- Drill testing (>300 drill holes)

- Open pit bulk sampling (2001): 13,835 tonnes returning 4,245 oz of gold for a reconciled grade of 9.84 g/t Au at a calculated recovery of 97% (milled at the Camflo Mill)

- Initial underground test mining with bulk sampling (2003-2004): 8,169 tonnes returning 2,596 oz of gold for a reconciled grade of 10.7 g/t Au (milled at the Camflo Mill)

In 2004, then operator Taurus was forced into near-bankruptcy while preparing the property for underground production. The company agreed to combine with American Bonanza Gold Mining Corporation (“American Bonanza”) to create a new company and also acquired Fairstar’s interest in the Fenelon gold property.

In 2005, a NI 43-101 compliant technical report reported Measured and Indicated resources after depletion of 47,927 tonnes grading 19.61 g/t Au (30,216 oz) and Inferred resources of 27,245 tonnes grading 12.79 g/t Au (11,203 oz)1. Additional drilling by American Bonanza was conducted from 2005 to 2008 (approximately 65 holes) targeting the Discovery Zone extensions and other targets on the property.

In late 2010, Balmoral Resources Ltd. (“Balmoral”) acquired American Bonanza’s Fenelon Gold property. In 2011, Balmoral drilled 41 holes testing the test lateral and down-dip/plunge extensions of the Discovery Zone and its eastern and northern ends. The drilling program extended some mineralized veins in the zone along strike and to a vertical depth of 250 metres.

In October 2016, Wallbridge completed the purchase of the Fenelon Gold property from Balmoral for a purchase price of $3.7 million and subsequently in March 2020 announced the acquisition of all of the issued and outstanding shares of Balmoral in an all-stock transaction valued at equivalent of $110 million, based on 28-day trading value of Wallbridge shares as of February 28, 2020.

1. These “resources” are historical in nature and should not be relied upon. It is unlikely they conform to current NI 43101 requirements or follow CIM Definition Standards, and they have not been verified to determine their relevance or reliability. They are included in this section for illustrative purposes only and should not be disclosed out of context.

- Geology and Mineralization

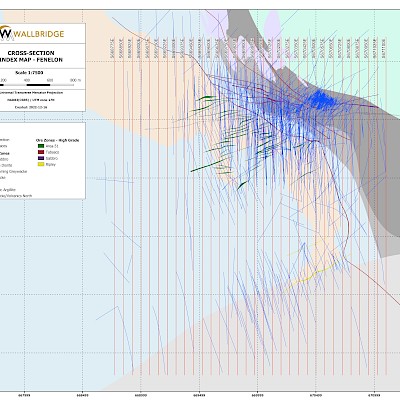

The Fenelon Gold project is located in the northwestern Archean Abitibi Subprovince, in the northernmost volcano-sedimentary belt segment. It is located less than 1 kilometre north of the Sunday Lake Deformation Zone (“SLDZ”) and is mainly underlain by a turbiditic sedimentary basin and the eastern margin of the Jérémie Pluton.

The gold mineralized zones defined to date are structurally controlled and affected by ductile deformation. The mineralization shares many similarities with orogenic gold deposits in terms of metal associations, wall-rock alteration assemblages and structural controls. Secondary splays of the SLDZ have controlled the emplacement of a significant gold system along and within the Jérémie Pluton. Historically, exploration has focused on the high-grade shear zones hosted in the Main Gabbro area (location of the open pit and underground workings).

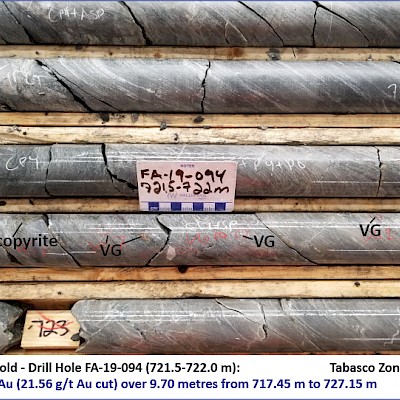

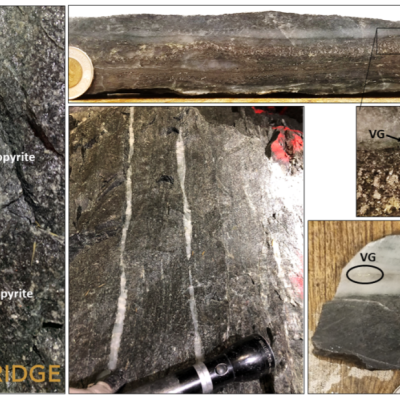

Three domains of gold mineralization are present on the property: The Main Gabbro zones, and the newly discovered Tabasco and Cayenne, as well as Area 51 zones. Gold is associated with disseminated pyrrhotite, chalcopyrite and pyrite, and minor sphalerite, arsenopyrite and marcasite. Native visible gold is fairly common in all zones.

The Main Gabbro area contains seven zones: the Fresno, Chipotle, Anaheim, Naga Viper, Paprika, Habanero and Serrano zones. These mineralized zones are restricted to a wide corridor of intensely altered gabbro between two panels of argillaceous sediments.

The Tabasco and Cayenne mineralized system occurs in turbiditic sediments between the Main Gabbro and the Jérémie Pluton. The zones trend northwest/southeast (130°) and dip steeply south. They form an anastomosing and sheared system with numerous secondary splays. The mineralization is discrete with a low sulphide content (<5%) and is mainly associated with silicification and sericitization. Gold intervals are associated with a pyrrhotite-chalcopyrite assemblage. Arsenopyrite and sphalerite are locally present. The best gold intervals associated with veining are in intersections with light grey quartz veins. High-grade gold intervals of more than 10 g/t over 0.5 to 1 m are common.

The Area 51 Zone is hosted in the Jérémie Pluton and its contact. It occurs as a series of parallel mineralized subzones grouped into two ENE-WSW trending corridors (Andromeda and Orion) parallel to the SLDZ. Gold mineralization is mainly associated with isolated or regularly spaced subparallel translucent grey quartz veins generally less than 2-3 cm thick.

Maps & Images (click to enlarge)

- Mineral Resource Estimate

Fenelon (effective date of January 13, 2023)

Notes on the MRE of the Fenelon Gold Project (January 13, 2023):

- The independent and qualified persons for the current Detour-Fenelon Gold Trend 2023 MRE are Carl Pelletier, P.Geo.,Vincent Nadeau-Benoit, P.Geo., Simon Boudreau, P.Eng. and Marc R, Beauvais, P.Eng., of InnovExplo Inc. The Detour-Fenelon Gold Trend 2023 MRE follows 2014 CIM Definition Standards and 2019 CIM MRMR Best Practice Guidelines. The effective date of the Detour-Fenelon Gold Trend 2023 MRE is January 13, 2023.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issue, that could materially affect the potential development of mineral resources other than those discussed in the Detour-Fenelon Gold Trend 2023 MRE.

- For Fenelon, 112 high-grade zones and seven (7) low-grade envelopes were modelled in 3D to the true thickness of the mineralization. Supported by measurements, a density value of 2.80 g/cm3 was applied to the blocks inside the high-grade zones, and 2.81 g/cm3 was applied to the blocks inside the low-grade envelopes. High-grade capping was done on raw assay data and established on a per-zone basis and ranges between 25 g/t and 100 g/t Au for the high-grade zones (except for the high-grade zones Chipotle and Cayenne 3 a high-grade capping values of 330 g/t Au was applied) and ranges between 4 g/t and 10 g/t Au for the low-grade envelopes. Composites (1.0 m) were calculated within the zones and envelopes using the grade of the adjacent material when assayed or a value of zero when not assayed. A minimum mining width of 2 metres was used for underground stope optimization.

- For Martiniere, 75 high-grade zones and nine (9) low-grade envelopes were modelled in 3D to the true thickness of the mineralization. Supported by measurements, a density value of 2.83 g/cm3 was applied to the blocks inside the high-grade zones (except for the high-grade zones associated with massive sulfide intersections where a value of 3.00 g/cm3 was applied), and 2.81 g/cm3 was applied to the blocks inside the low-grade envelopes. High-grade capping was done on raw assay data and established on a per-zone basis and ranges between 25 g/t and 100 g/t Au for the high-grade zones and ranges between 1 g/t and 6 g/t Au for the low-grade envelopes. Composites (1.0 m) were calculated within the zones and envelopes using the grade of the adjacent material when assayed or a value of zero when not assayed. A minimum mining width of 2 metres was used for underground stope optimization.

- The criterion of reasonable prospects for eventual economic extraction has been met by having constraining volumes applied to any blocks (potential surface and underground extraction scenario) using Whittle and DSO and by the application of cut-off grades. The cut-off grade for the Fenelon deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $5.50/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $65.00/t for the underground portion and a G&A cost of $9.20/t. Values of metallurgical recovery of 95.0% and royalty of 4.0% were applied during the cut-off grade calculation. The cut-off grade for the Martiniere deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $4.55/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $118.80/t for the underground portion using the long-hole mining method (LH), a mining cost of $130.70/t for the underground portion using the cut and fill mining method (C & F), a G&A cost of $9.20/t and a transport to process cost of $6.50/t. Values of metallurgical recovery of 96.0% and royalty of 2.0% were applied during the cut-off grade calculation. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

- Results are presented in-situ. Ounce (troy) = metric tons x grade/31.10348. The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

- Maps and Sections

- Technical Report

- Mineral Resource Estimate

Sign Up for News

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Position Title | Status | Location |

|---|---|---|

| Senior Geologist | Schedule 14-14 | Fenelon |