Press

Releases

Martinière Project, Québec, Canada

Project Snapshot

| Status: | Advanced exploration stage (mineral resource) |

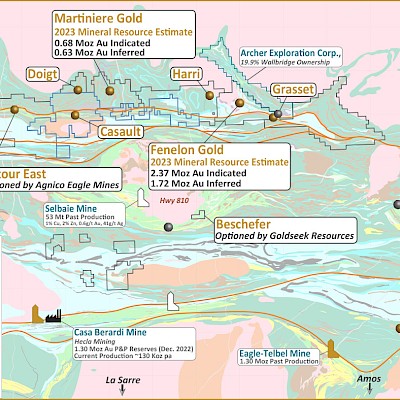

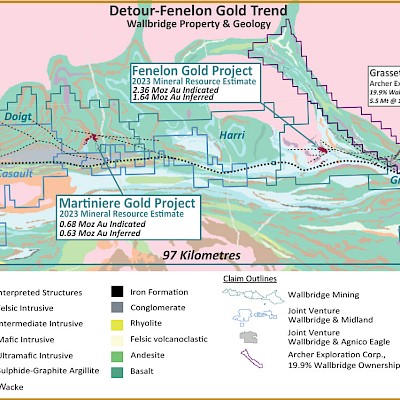

| Location: | Detour-Fenelon Gold Trend ~45 km east of Detour Lake gold mine (Agnico Eagle Mines) and 30 km west of Fenelon Gold |

| Commodity: | Gold |

| Ownership: | 100% Wallbridge |

| Current exploration activities: | Over 48,000 metres of drilling completed by the Company since the acquisition of the project (2021-2023). Over 12,000 metres of resource drilling, as well as technical studies are planned for 2024. |

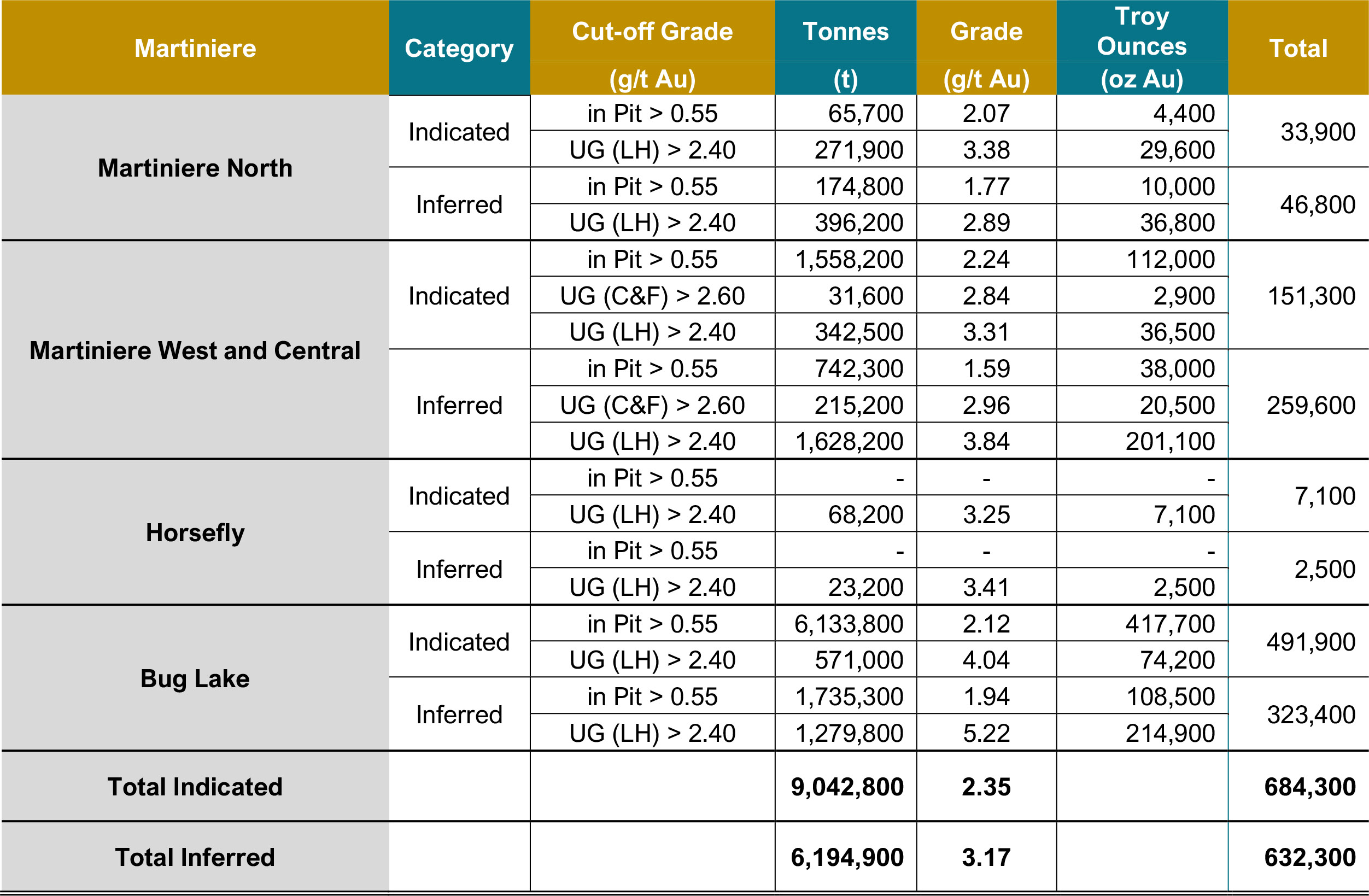

| Mineral resources: | 684,300 oz Au indicated and 632,300 oz Au inferred |

-

Overview

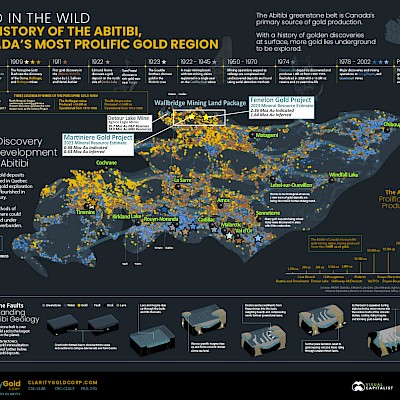

The Martinière project is located approximately 110 km west of the town of Matagami and 150 km north of Amos, Québec, Canada. Martiniere is the second major gold project within the Company’s extensive land package along the Sunday Lake Deformation Zone ("SLDZ"). The project is 45 kilometres east of the Detour Lake mine operated by Agnico Eagle Mines. In January 2023, the Company announced an updated mineral resource of 684,300 ounces Au indicated and 632,300 ounces Au inferred.

Balmoral acquired the Martinière project in November 2010 and, from 2011 to 2017, drilled 133,852 metres in 519 diamond drill holes and reported an initial mineral resource estimate in March 2018. Their work expanded the historical intercepts on the project into the Bug and Martinière West gold deposits and identified several additional zones and showings, including VMS mineralization. The project currently has a known mineralized footprint of 2 km by 2 km.

The 2023 MRE for Martiniere in 2023, includes 0.68 million ounces of indicated gold resources and 0.63 million ounces of inferred gold resources. This represents a significant increase both in gold grade and contained ounces compared to the 2021 MRE. Details of the 2023 MRE results can be found in the Wallbridge press release dated January 17, 2023.

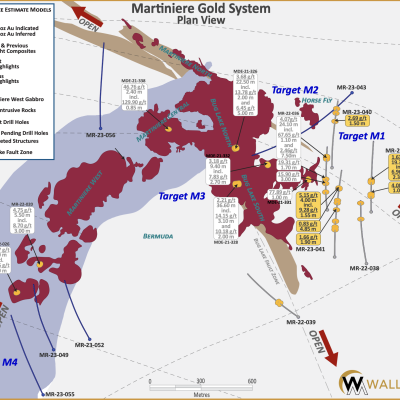

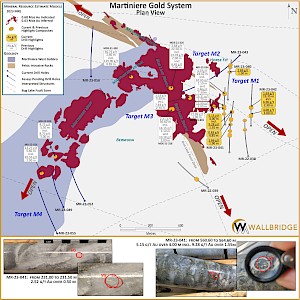

The over 48,000 metres of drilling completed at Martiniere by Wallbridge in 2021-2022 successfully established the connection between the Martiniere West and the Bug Lake Trends, extending known zones along strike and at depth and discovering new mineralized zones (see Wallbridge press releases dated August 30 and October 12, 2022).

Both mineralized gold trends at Martiniere are open along strike and remain largely untested below 400 metres of vertical depth. In addition, there are numerous promising exploration targets that have the potential to host new gold zones and satellite deposits.

Maps & Images (click to enlarge)

- Current Program

The budgeted drilling in 2024 will be carried out in two phases: Phase 1 of approximately 7,500 metres is scheduled for March and April 2024, with Phase 2 of approximately 5,500 metres planned for the third quarter of the year.

The Phase 1 program is designed to increase confidence in the MRE by collecting representative material for metallurgical test work and doing down-hole geotechnical imaging to further improve our understanding of the structural controls on gold deposition. Phase 2 will be targeting extensions of known gold zones both laterally and down-plunge at depth in order to further expand the deposit. The Company also plans to sample in-fill drill core (approximately 5,000 metres) from historic drilling programs that has not been previously analyzed to potentially identify further gold mineralization in the deposit area.

Technical studies for Martiniere, including metallurgical test work, geomechanics and hydrogeology are scheduled to start in early 2024.

The 2023 Martiniere MRE of 0.68 million ounces of gold in the Indicated category and 0.63 million ounces of gold in the Inferred category represents a significant increase both in gold grade and contained ounces compared to the 2021 MRE.

The 48,000 metres of drilling completed at Martiniere by Wallbridge in 2021-2023 successfully established the connection between the Martiniere West and the Bug Lake Trends, extending known zones along strike and at depth and discovering new mineralized zones.

Both mineralized gold trends at Martiniere are open along strike and remain largely untested below 400 metres of vertical depth. In addition, there are numerous promising exploration targets that have the potential to host new gold zones and satellite deposits.

Maps & Images (click to enlarge)

- Brief History

Gold on the Martinière project was discovered in 1997 by Cyprus Canada Inc. Their drilling program of 8 holes intersected three separate auriferous horizons. In 1998, the property was acquired by International Taurus Resources Inc. (merged with American Bonanza in 2004) and in 1999 and 2000, they completed 21 drill holes totaling 3,807 metres. The highlight of the 2000 drill program was an intercept of 14.40 g/t Au over 4.20 m from the Central Zone. Results indicated that the higher-grade gold mineralization was contained in veins and shoots, similar in nature to the high-grade gold mineralization on the Fenelon Gold project.

American Bonanza’s drilling program during 2006-07 (22 holes) expanded the extent of known gold mineralization in the West and Central Zones and led to the discovery of the Martinière East Zone (Hole MD07-20 intersected 2.30 g/t Au over 28.40 m). This was the most easterly drill hole on the property at the time and indicated the potential for bulk tonnage gold zones. American Bonanza sold the property to Balmoral Resources Ltd. (“Balmoral”) in 2010 without completing any further work.

Balmoral completed several phases of drilling from 2011 to 2017 totaling 133,852 metres in 519 diamond drill holes which have outlined two major gold bearing trends - the Martinière West and Bug Lake shear zones - as well as several high-grade gold occurrences outside these trends. An initial mineral resource estimate was published in March 2018.- Geology and Mineralization

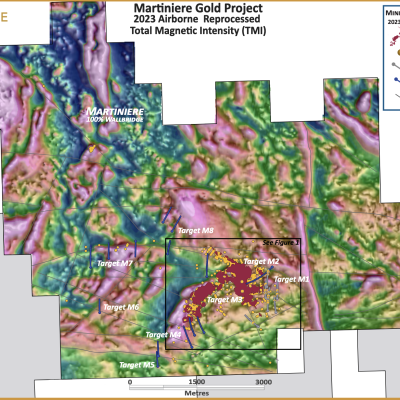

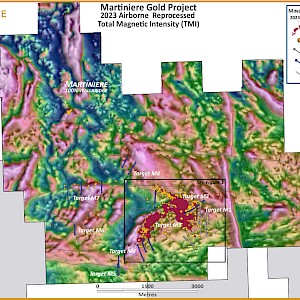

The Martiniere Block is mostly flat and covered by glacial overburden that averages 22.5 m thick. Only a few outcrops are present along the Martigny River and on higher ground in the northwest part of the claim block, consisting mostly of mafic volcanic and/or intrusive rocks. The geophysical interpretation (by the MRNF) of the boundaries between lithological units suggests that most of the Property is underlain by mafic volcanics and gabbro of the Manthet Group, with lesser sedimentary rocks, felsic tuff and younger diabase dykes. Granitoid gneiss of the Opatica Subprovince underlies the northwest corner of the claim block.

The Martiniere Block is mostly flat and covered by glacial overburden that averages 22.5 m thick. Only a few outcrops are present along the Martigny River and on higher ground in the northwest part of the claim block, consisting mostly of mafic volcanic and/or intrusive rocks. The geophysical interpretation (by the MRNF) of the boundaries between lithological units suggests that most of the Property is underlain by mafic volcanics and gabbro of the Manthet Group, with lesser sedimentary rocks, felsic tuff and younger diabase dykes. Granitoid gneiss of the Opatica Subprovince underlies the northwest corner of the claim block.Recent interpretations by the issuer, also based on work by the MERN and CONSOREM, indicate that the volcano-sedimentary package is openly folded in the deposit area. Rock types consist mostly of mafic volcanics and gabbroic sills, with minor felsic intrusions, graphitic argillite, and massive sulphides. Sulphide minerals consist almost entirely of pyrite. A younger generation of quartz porphyry intrusions locally forms subvertical dykes that play an important role in localizing gold mineralization.

The most prominent structures in the Martiniere Block area are E-W striking, possibly crustal-scale, deformation corridors like the SLDZ, which passes through the southern part of the claim block, and the smaller and more recently discovered Lac du Doigt Deformation Zone (“DDZ”), WNW-striking, cutting through the centre of the Property. Another important structure on the Property is the NNW-trending Bug Lake Fault Zone (“BLFZ”) that hosts the Bug Lake deposit. The BLFZ dips approximately 60-80° to the east and has a planar to sigmoidal form in cross-section, showing steeply dipping ramps (or “steeps”) and shallower flats. The BLFZ hosts the Bug Lake quartz porphyry and is characterized by a strong deformation fabric with silica-sericite-carbonate alteration, increased disseminated pyrite content and fault breccia texture. Alteration is associated with a set of diffuse quartz-carbonate ± pyrite veins that locally exhibit coliform texture. Movement along the BLFZ appears to have included: (1) ductile shearing as marked by increased penetrative deformation fabric in volcano-sedimentary rocks, (2) brittle shearing represented by re-healed breccia (typically with calcite in-fill), and (3) brittle faulting marked by broken ground, with clay coatings on fracture surfaces and rare fault gouge.

The Martiniere West and Central zones are hosted within the Martiniere West Trend, a more diffuse, stratiform structure marked by a weak penetrative deformation fabric, with around 1-5% disseminated pyrite and localized silicification. The Martiniere West Trend is developed within a gabbroic sill and oriented at an angle of around 60° to the BLFZ.

Maps & Images (click to enlarge)

- Mineral Resource Estimate

Balmoral reported a mineral resource estimate for the Martinière project in March 2018, which was prepared by Ginto Consulting Inc. (Vancouver, BC). The resource estimate included separate estimates for the Bug and Martinière West gold deposits.

These “Resources” are historical in nature and should not be relied upon. The qualified persons of the March 2021 Technical Report have not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although they comply with current NI 43-101 requirements and follow CIM Definition Standards, they are included in this section for illustrative purposes only and the issuer is not treating the historical estimate as current mineral resources.

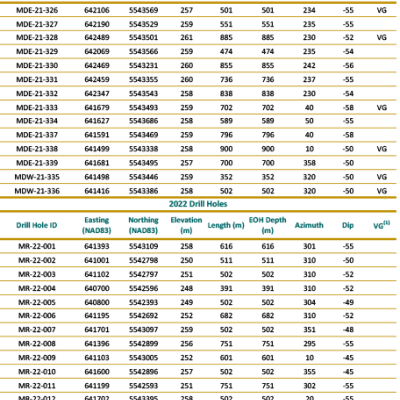

Martiniere (effective date of January 13, 2023)

Notes on the MRE of the Martiniere Project (January 13, 2023):

- The independent and qualified persons for the current Detour-Fenelon Gold Trend 2023 MRE are Carl Pelletier, P.Geo.,Vincent Nadeau-Benoit, P.Geo., Simon Boudreau, P.Eng. and Marc R, Beauvais, P.Eng., of InnovExplo Inc. The Detour-Fenelon Gold Trend 2023 MRE follows 2014 CIM Definition Standards and 2019 CIM MRMR Best Practice Guidelines. The effective date of the Detour-Fenelon Gold Trend 2023 MRE is January 13, 2023.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability.

- The QPs are not aware of any known environmental, permitting, legal, title-related, taxation, sociopolitical or marketing issues, or any other relevant issue, that could materially affect the potential development of mineral resources other than those discussed in the Detour-Fenelon Gold Trend 2023 MRE.

- For Fenelon, 112 high-grade zones and seven (7) low-grade envelopes were modelled in 3D to the true thickness of the mineralization. Supported by measurements, a density value of 2.80 g/cm3 was applied to the blocks inside the high-grade zones, and 2.81 g/cm3 was applied to the blocks inside the low-grade envelopes. High-grade capping was done on raw assay data and established on a per-zone basis and ranges between 25 g/t and 100 g/t Au for the high-grade zones (except for the high-grade zones Chipotle and Cayenne 3 a high-grade capping values of 330 g/t Au was applied) and ranges between 4 g/t and 10 g/t Au for the low-grade envelopes. Composites (1.0 m) were calculated within the zones and envelopes using the grade of the adjacent material when assayed or a value of zero when not assayed. A minimum mining width of 2 metres was used for underground stope optimization.

- For Martiniere, 75 high-grade zones and nine (9) low-grade envelopes were modelled in 3D to the true thickness of the mineralization. Supported by measurements, a density value of 2.83 g/cm3 was applied to the blocks inside the high-grade zones (except for the high-grade zones associated with massive sulfide intersections where a value of 3.00 g/cm3 was applied), and 2.81 g/cm3 was applied to the blocks inside the low-grade envelopes. High-grade capping was done on raw assay data and established on a per-zone basis and ranges between 25 g/t and 100 g/t Au for the high-grade zones and ranges between 1 g/t and 6 g/t Au for the low-grade envelopes. Composites (1.0 m) were calculated within the zones and envelopes using the grade of the adjacent material when assayed or a value of zero when not assayed. A minimum mining width of 2 metres was used for underground stope optimization.

- The criterion of reasonable prospects for eventual economic extraction has been met by having constraining volumes applied to any blocks (potential surface and underground extraction scenario) using Whittle and DSO and by the application of cut-off grades. The cut-off grade for the Fenelon deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $5.50/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $65.00/t for the underground portion and a G&A cost of $9.20/t. Values of metallurgical recovery of 95.0% and royalty of 4.0% were applied during the cut-off grade calculation. The cut-off grade for the Martiniere deposit was calculated using a gold price of US$1,600 per ounce; a CA/US exchange rate of 1.30; a refining cost of $5.00/t; a processing cost of $18.15/t; a mining cost of $4.55/t (bedrock) or $2.15/t (overburden) for the surface portion, a mining cost of $118.80/t for the underground portion using the long-hole mining method (LH), a mining cost of $130.70/t for the underground portion using the cut and fill mining method (C & F), a G&A cost of $9.20/t and a transport to process cost of $6.50/t. Values of metallurgical recovery of 96.0% and royalty of 2.0% were applied during the cut-off grade calculation. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

- Results are presented in-situ. Ounce (troy) = metric tons x grade/31.10348. The number of tonnes and ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

- Maps and Sections

- Technical Report

- Current Program

Sign Up for News

Sign Up for Our Mailing List

By entering your information, you consent to receive emails from Wallbridge Mining and agree to our Privacy Policy.

Join Our Team

Wallbridge Mining Company Limited is an equal opportunity employer.

Job offers at Wallbridge Mining

| Position Title | Status | Location |

|---|---|---|

| Community Relations Coordinator | Schedule 5-2 or 4-3 | Fenelon |

| Environmental Coordinator | Schedule 4-3 | Fenelon |